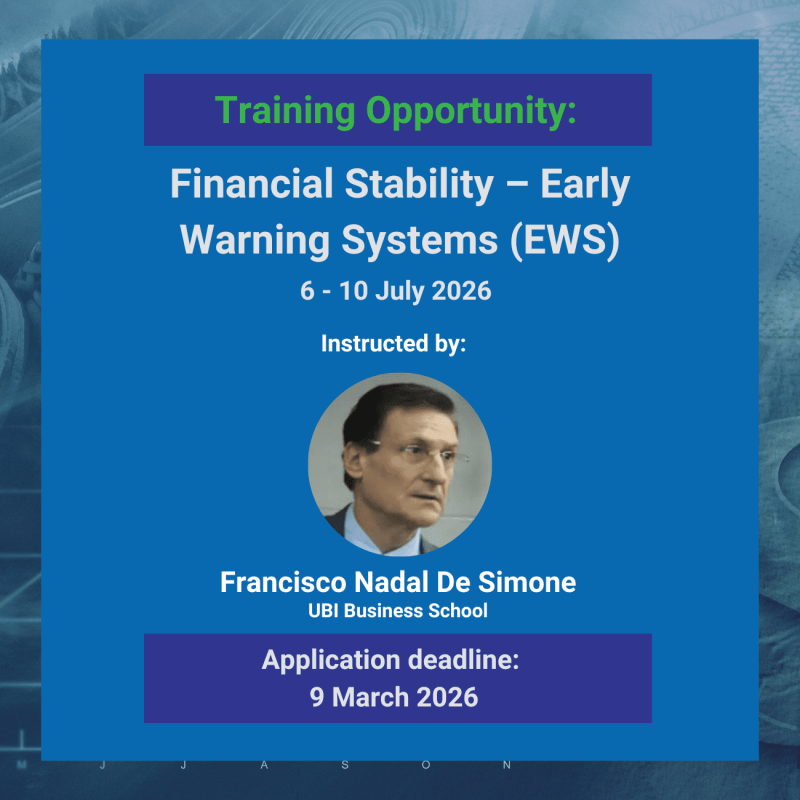

Economic Research Southern Africa (ERSA) invites applications for a skills workshop on the early warning systems for financial stability, instructed by Prof. Francisco Nadal De Simone.

Course overview

This five-day hands-on workshop covers key issues of developing Early-Warning Systems (EWS) for financial stability. The course will include exercises where selected models will be run using real data. The aim of the exercises is for participants, especially practitioners, to understand the input into the EWS models, interpret the results, and discuss reasonable threshold selection for EWS indicators. The course will conclude with lessons from the application of EWS to the design of macroeconomic and financial policies and recommendations, using the Luxembourg financial center as an example.

Assumed prior knowledge

The course assumes that participants have completed Honours courses of microeconomics, macroeconomics and statistics. Having completed Masters courses of open-macroeconomics, finance and econometrics would be an advantage.

Knowledge and access to MATLAB and Rats will be advantageous, but not necessary.

Course outline (Tentative)

Day 1: Overview of EWS

- Review the principles and scientific literature on the foundations of EWS.

- Introduce the basic analytics and process of the EWS in terms of objectives, inputs, and main outputs. Data, methodologies, and econometric models are presented and discussed. Introduce EWS for currency crisis; EWS for banking sector; EWS for the real estate sector; EWS for the sovereign.

Day 2 : Introduction to Risk measures for EWS

- Discrete approach (Probit and Logit).

- Signalling approach (ROC, AUROC).

- Data analysis and treatment.

- Default probabilities, Merton model and Delianedis and Geske model.

Day 3: Selected Systemic Risk Measures for EWS I

- Correlation analysis.

- Value at Risk (VaR); Conditional Value at Risk (CoVaR); Expected Systemic Shortfall (SES).

- Networks, interconnectedness, and cross-sectoral risk interdependence in the financial system.

- VAR, FAVAR and the Generalized Dynamic Factor model.

Day 4: Selected Systemic Risk Measures for EWS II – Default Dependency

- Consistent Information Multivariate Density Optimization (CIMDO).

- The financial sector, the non-financial corporations and households.

- The sovereign.

- Alternative procedures to threshold determination.

Day 5: Infrastructure

- Building a framework for EWS (basic institutional infrastructure, mandate, reporting, communication, accountability, coordination among regulatory bodies).

- Building a database for EWS (data gathering, control, sharing, confidentiality issues).

Instructors

Prof. Francisco Nadal De Simone obtained a CPA and a MSc(Econ) (magna cum laude) at the University of Cuyo, Argentina. His PhD is from the Graduate Institute of International and Development Studies, University of Geneva. He worked at the World Trade Organization, the Reserve Bank of New Zealand, the International Monetary Fund, and the Central Bank of Luxembourg (BCL), Eurosystem. He represented the BCL at the Committee on Global Financial Stability of the Bank for International Settlements and at the Financial Stability Committee of the European Central Bank. He taught macroeconomics at the National University of Singapore and finance at its Business School. He has offered training seminars at the Central Bank of China and Vietnam regulatory bodies and its Central Bank. He has lectured in international economics, banking and financial stability at Christ’s College, Cambridge, UK, the University of Luxembourg, and the Luxembourg UBI Business School. He has published extensively in economics and finance.

Target Participants

Master’s students, PhD candidates, and postdoctoral researchers in economics or finance, as well as researchers and policymakers working in financial stability, holding at least a Master’s degree in Economics or Finance.

Application Process and Requirements

Interested applicants must submit their application by 9 March 2026. Application decisions will be communicated by 23 March 2026.

ERSA will cover domestic travel (within South Africa) and accommodation costs for participants based at South African institutions. For students based outside of South Africa, ERSA will cover accommodation and domestic travel within South Africa, while international flights will be the responsibility of the participant.

Places are limited to 25 participants, and funding to attend the workshop is entirely at the discretion of the organisers.

Contact

For more information and registration details, please contact Claudine Tshabalala.